The Truth About “Flat” Home Prices

10/9/25

If you’ve been skimming real estate headlines lately, you’ve probably seen the phrase home prices are flat pop up a few times. Sounds simple, right? Flat means steady, nothing changing. But here’s the truth, it’s not nearly that straightforward.

Because in most markets, prices aren’t actually flat at all.

What the Data Really Shows

Yes, prices have cooled off from the wild, unsustainable rollercoaster of 2020–2022 (remember those days?). But how much they’ve changed really depends on where you are.

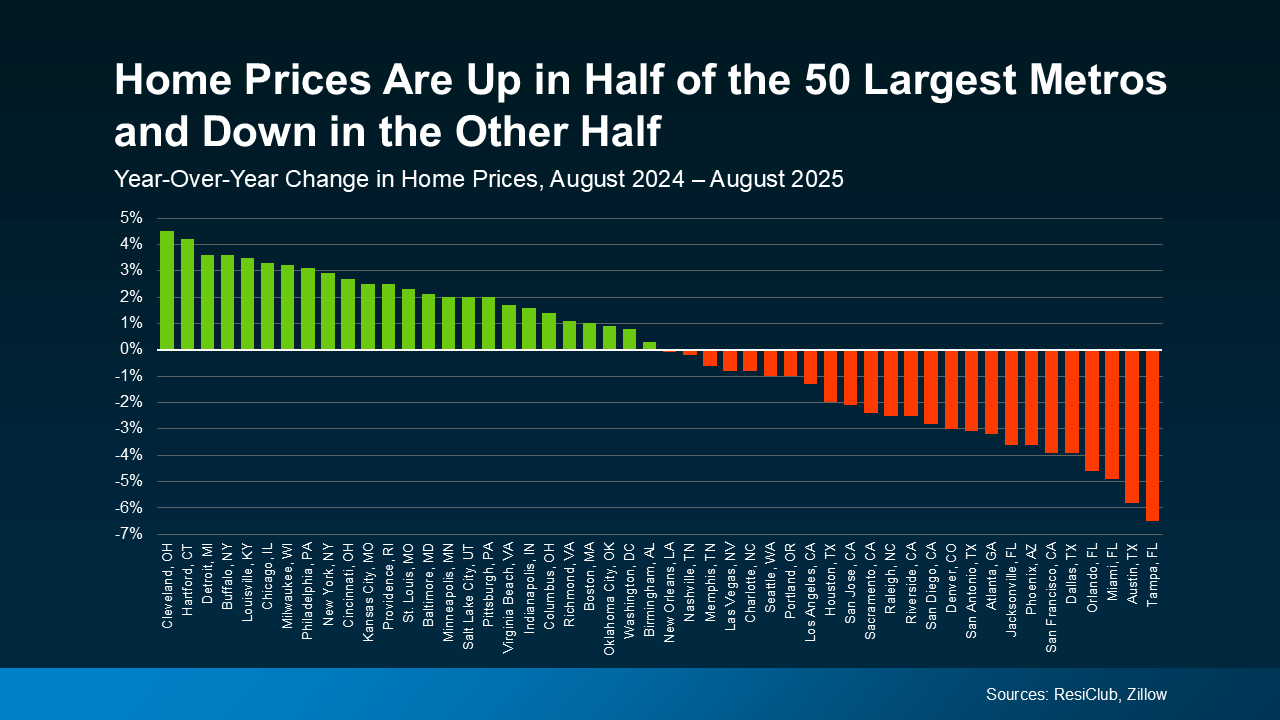

Data from ResiClub and Zillow covering the 50 largest metro areas makes it crystal clear that the market is split almost right down the middle. Half of those cities are still seeing prices tick up, while the other half are seeing slight dips.

So when you average all that out, you get a national number that looks flat. But that’s just math, not the full story. What the numbers actually show is how much price trends are going to vary depending on where you are.

One big reason for the divide? Inventory. The Joint Center for Housing Studies (JCHS) of Harvard University explains it nicely:

“. . . price trends are beginning to diverge in markets across the country. Prices are declining in a growing number of markets where inventories have soared while they continue to climb in markets where for-sale inventories remain tight.”

In other words, when some markets have more homes for sale and others are still starved for inventory, the national picture ends up looking “flat.” But what’s actually happening on the ground feels very different depending on your zip code.

And before you start worrying about those declines — remember, many of the places seeing small price drops right now were the same ones that saw massive gains during the pandemic boom. Prices climbed roughly 50% nationally over the past five years — and even more in some of those “correcting” markets. So a little softening now doesn’t erase all that growth.

The good news? Experts aren’t projecting a nationwide decline anytime soon.

If You’re Buying...

Local trends matter a lot! They’ll shape how quickly you need to act, how strong your offer should be, and whether you’ve got wiggle room for negotiating.

Here’s how it plays out:

If prices are still inching up in your area, waiting could mean paying more later.

If prices are easing, you may be able to negotiate on things like repairs or closing costs.

Bottom line: knowing your local market gives you power — and peace of mind.

If You’re Selling...

The same rule applies: stay local. What’s happening in the national news isn’t nearly as important as what’s happening on your street and in your neighborhood.

In areas where prices are still rising, you might not need to budge much on your asking price.

But if prices are coming down, setting the right price from the start (and being ready to negotiate) is key to selling smoothly.

And this is where having a savvy local agent makes all the difference. Pricing a home right the first time is everything right now because homes that hit the market priced correctly? They’re still selling!

The Real Story Is Local

National averages can be helpful for spotting general trends, but they can’t tell you what’s happening in your own backyard.

As Anthony Smith, Senior Economist at Realtor.com, explains:

“While national prices continued to climb, local market conditions have become increasingly fragmented…This regional divide is expected to continue influencing price dynamics and sales activity as the fall season gets underway.”

That’s why having a local expert (hi 👋) matters more than ever. Someone who actually knows the Dallas neighborhoods, studies the data, and can translate it into real-world guidance. Whether you’re buying, selling, or just trying to make sense of all the headlines.

Bottom Line

Those “flat price” headlines might make for catchy clickbait, but they don’t tell the full story, but I can.

Let’s connect and talk about what’s really happening with home prices in your Dallas neighborhood.

Whether you’re planning to buy, sell, or just stay informed, I’ll make sure you’ve got the local insight you need to feel confident about your next step.

Source: Keeping Current Matters, Inc.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice.

Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.