Could 2025 Be Your Year?

9/17/25

Mortgage rates are finally moving in the right direction – and buyers are jumping back in.

Here’s the stat that matters: applications for home loans are up 23% compared to the same week last year, according to the Mortgage Bankers Association.

Translation? Buyers are back, and demand is the highest it’s been since July.

If you’ve been waiting to sell (or your listing sat without offers earlier this year), this might be your green light.

When Rates Drop, Buyers React Fast

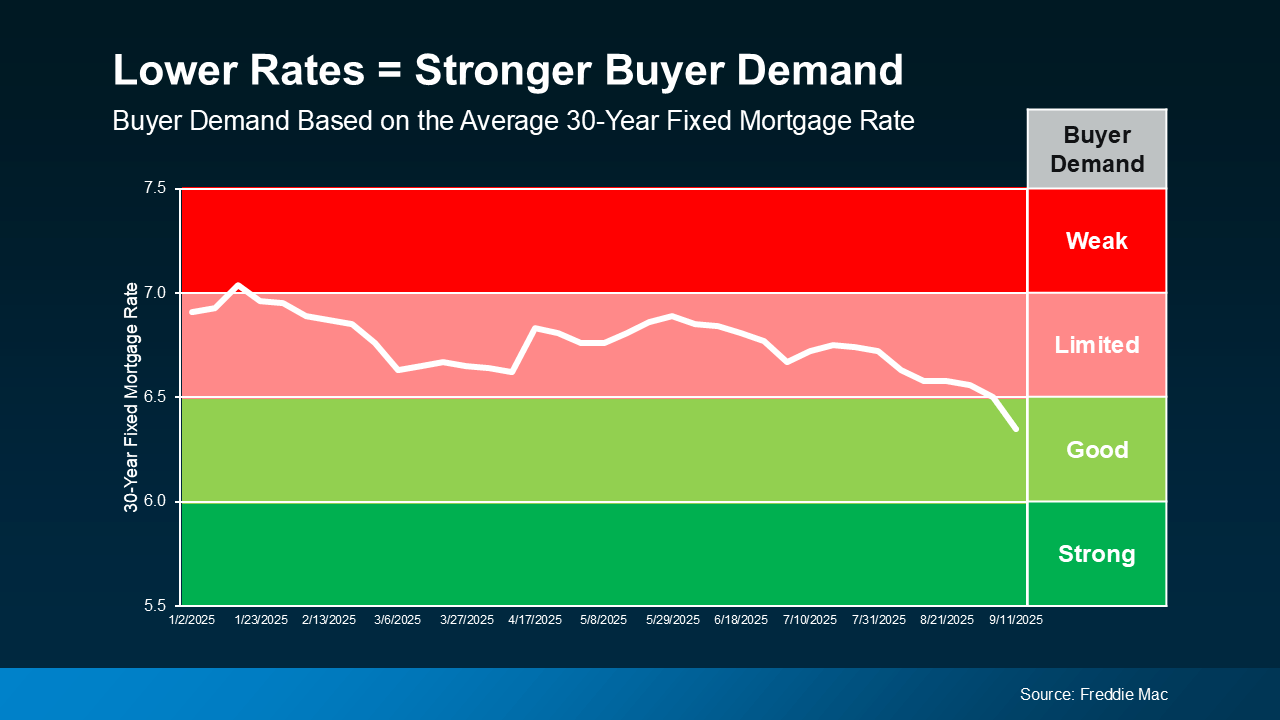

The 30-year mortgage rate just dipped to 6.13%, the lowest since October 2024. That drop followed weaker job growth and speculation the Fed may cut rates multiple times this year.

And here’s the thing: today’s buyers are hyper-sensitive to even the smallest shift in affordability. When rates go down…even a little…demand goes up. (Check out the graph 👇🏽).

We’ve been in a “meh” buyer demand phase for about a year, but that’s changing. The energy is shifting, and you can feel it.

What This Means For You

If you’re ready to move, this is your chance to use the market to your advantage.

Expired listing? Buyers are back, and your home could have a whole new pool of interest.

Been waiting it out? You can get ahead of the competition before other homeowners realize the tide is turning.

Sure, if rates drop further, more buyers may show up, but more sellers will, too.

Why risk blending into the crowd when you can stand out now?

Bottom Line

Buyers are watching rates, paying attention, and starting to make moves. If you’re even thinking about selling, this could be your window to act before the rest of the neighborhood catches on.

Want to make sure your house shows up for the right buyers at the right time? Let’s connect and map out your strategy.

Source: Keeping Current Matters, Inc.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice.

Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.