Holiday Market Buzz

12/3/2025

It doesn’t matter if you’re at your company party, your in-laws’ dinner table, or standing in line for peppermint hot chocolate…somebody’s bringing up the housing market. It’s basically the unofficial fourth topic of small talk after weather, football, and “how’s work?”

So let’s break down the three questions I’m hearing on repeat right now—and give you the real, no-drama answers to help you feel a little more confident heading into the new year.

1. “Will I even be able to find a home if I want to move?”

Short answer: Yep! And, definitely more than a year or two ago.

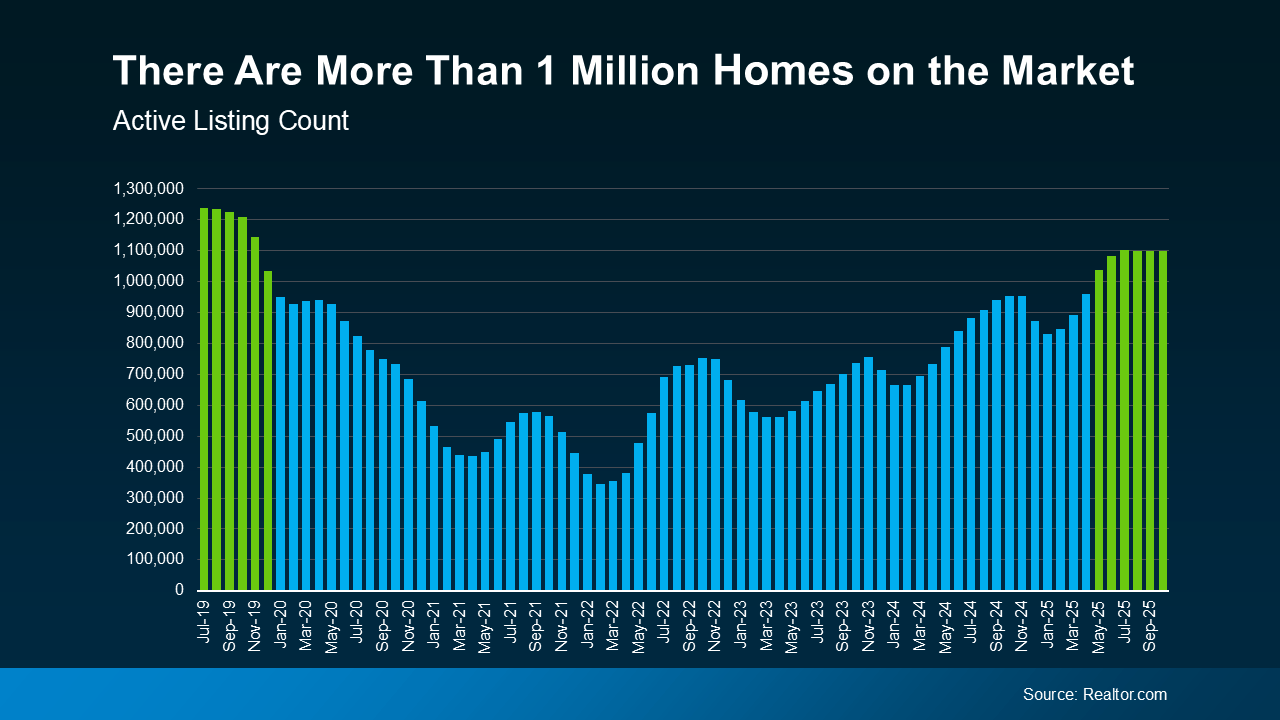

The number of homes for sale has been climbing, and according to data from Realtor.com, we’ve had over one million homes on the market for six straight months. This is the first time that’s happened since 2019.

What that means for you:

Buyers have actual options again.

Sellers have more places to go next. (Cue a collective sigh of relief!)

If you pressed pause last year because everything felt picked over, good news: the shelves aren’t bare anymore. And since inventory has ticked up, homes aren’t evaporating within 24 hours like they were in peak frenzy mode.

Translation: more time, more choices, fewer panic offers. Love that for you!

2. “Will I ever be able to afford a house?”

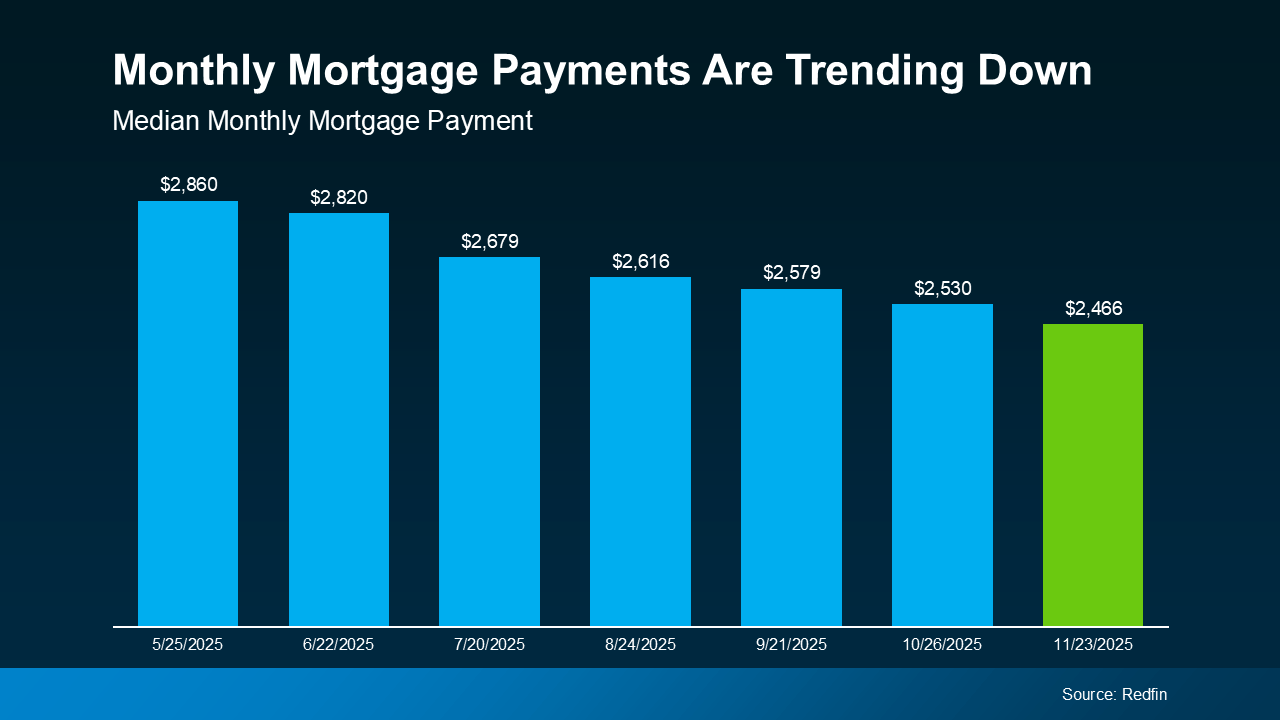

Affordability is finally (finally!) starting to improve. Listen, the last few years were a tough ride for buyers. But 2025 is handing us a few wins:

Mortgage rates have been easing.

Home price growth has been moderating.

Put those together and you get a monthly mortgage payment that’s hundreds of dollars lower than it would’ve been just a few months back. (Yes, really, check out the graph below.)

Buying isn’t suddenly easy-breezy, but the path is getting less uphill. For a lot of people, homeownership is feeling reachable again and that’s a big deal.

3. “Should I wait for prices to come down?”

Ah yes, the classic waiting game. A lot of people are bracing for a crash, but the data isn’t heading in that direction. Yes, inventory is rising, but it’s still nowhere near the level needed for a national price drop.

Plus, today’s homeowners have strong equity positions and healthier finances than during 2008 when the last crash happened. We’re just not in the same scenario.

Local markets vary (because of course they do)…some still rising, others leveling off or seeing slight corrections. But zooming out, experts surveyed by Fannie Mae expect home prices to keep rising, just at a calmer, more normal pace.

That’s why waiting for a big price dip isn’t the winning strategy people hope it is. Historically, the people who do best? The ones who spend time in the market, not those trying to time it perfectly.

Bottom Line

Housing talk gets noisy, fast. If you’re hearing a dozen different opinions from your aunt, cousin, your coworker, and that one neighbor who “just knows things,” let’s cut through the chatter.

If you want to understand what these trends mean for your goals, let’s connect.

I’ll walk you through it all, minus the confusion and the clickbait.

Source: Keeping Current Matters, Inc.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice.

Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.